Harnessing the Power of the Consumer Value Equation

Business thrives on stability and certainty so states conventional wisdom; the kind of opposite to the landscape our industry is currently navigating.

Cost-of-living pressures, climate anxiety, geopolitical instability, a fractured digital culture…A PESTLE analysis never looked so alarming!

In this article I will look at how consumer decision making has changed and what value expectations consumers will have going forward from the food and drink they seek? We refer to this as the Consumer Value Equation (CVE).

These are the 6 elements that make up the consumer value equation based on our current consumer insight*

*Source: Visionise Xoomer and Zillennial Jury data Dec 2024/Feb 2025

The elements are either unchanged, in ascendency or in decline in terms of salience with consumers in the current marketplace based on our latest consumer insights.*

Quality and Taste, whilst important is now often taken as a given by consumers in terms of their decision-making process but they will either reject or replace products that they feel underperform.

Health & Ethics haven’t really changed as neither seem to have been clarified or solved in consumer’s perception despite an incredible level of awareness and activity. However, Ethics is showing a slight decline in consumer saliency as the say-do gap has been heightened by affordability challenges and a growing sense of powerlessness perceived by younger

Value is currently driven by price consciousness which is very high on the consumer agenda and is likely to remain so as inflation rears its head again and supermarkets try to mask the impact with their “price war”.

Appeal, which refers to the allure of a product or brand, is highly fuelled by social media campaigns and the power of Tik Tok to generate awareness-it plays an increasingly bigger role in the consumer value equation especially with cohorts like the Zillennials. Whilst products can gain rapid awareness they are also prone to equally sharp drops in popularity once trends have moved on e.g. Prime Hydration dropping £63m in sales in 2024 2 years after launch and in a growing sector.

Convenience remains the forever driver that continues to retain consumer saliency despite all the focus on UPFs over the recent months-the recent announcement of Greencore buying Bakkavor will underpin the proliferation of convenience foods in the UK as these 2 super-manufacturers come together.

Understanding how consumers gauge value from the various products they buy and consume has never been more critical to helping businesses prioritise their focus areas to deliver all important growth (see Alt In Box article The Big G)

Most CEOs and C Suite Leaders we work with have a mental dashboard of key focus areas that will normally fluctuate in relevance and importance month by month and sometimes even daily-this is what we refer to as their Alternative InBox.

A challenging overlay to this balancing act for current leaders is the fact that most Boards seem to work to their own agenda and lack cohesion -this has long been a recognised issue but a combination of increased specialism; technical detail for example, and logistical challenges like time and location have exacerbated the issue.

What’s often referred to as “silo mentality” is still very much prevalent in our Industry starting with senior leadership and percolating down.

Understanding the consumer value equation is not only critical to fuelling the growth engine of the business it also provides a point of unification for the various departmentally focused members of the management team.

““Sales is not and should never be the sole preserve of the so-called commercial team””

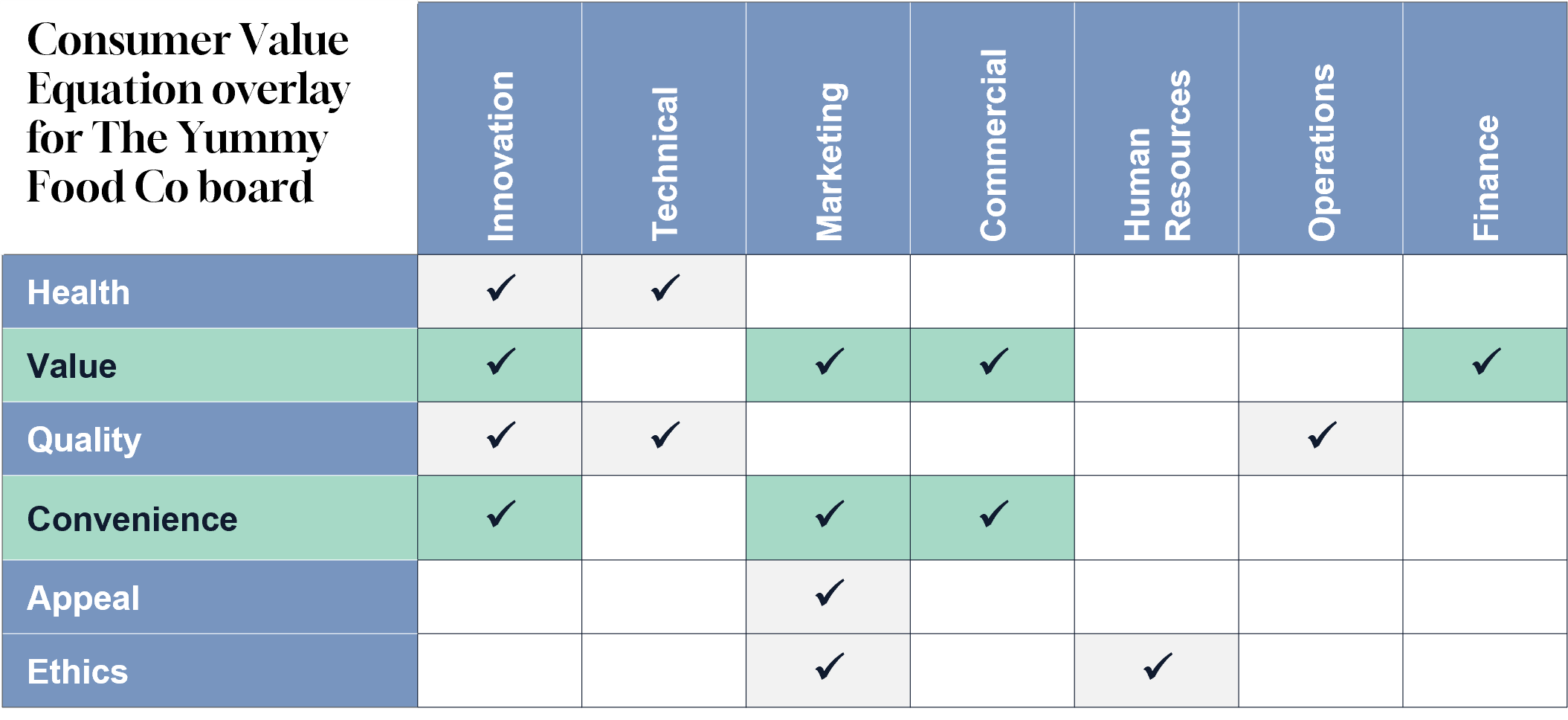

To understand this better let’s take an example of a mid-sized own label food business -supplying chilled food into the UK supermarkets. let’s call this business The Yummy Food Co (TYFC).

The Board of TYFC is likely to be made up of leaders focused on the following disciplines:

Innovation

Technical

Marketing

Commercial or sales

Human Resources

Operations

Finance

This is for illustrative purposes only and roles are often blended e.g. Operations will manage Technical and ESG-sometimes Commercial will mage marketing and Innovation.

It is likely that only the traditionally outward- facing disciplines (sales -marketing and innovation) will consider the consumer value equation in their decision making…and that’s not guaranteed.

So how do CEOs and Leaders use the Consumer Value Equation as a unifying focus for their Board?

If you transpose the Value equation onto TYFC Board structure you can see where the main responsibilities correlate with the elements of the CVE and from that derive the impact areas where the teams should focus…convenience food that is both appealing and great value

I am a passionate believer that in tough times we should all come together to enhance our ability to battle through-and by using the needs and expectations of our ever more discerning consumers to guide us to the main focus areas and to help us develop a cohesive team is a proven way of achieving this.

Using the Consumer value equation to make convenient product solutions both great value and super appealing and as a tangible unifying focus area for Board action will reward food and drink businesses by upskilling all disciplines in customer engagement and also act as a reminder of the commercial purpose at the heart of the business.